As businesses grow and handle increasing volumes of customer data, security and compliance become top priorities. But when organizations start researching audit frameworks, many encounter two common terms: SOC 1 and SOC 2.

Both are compliance reports under the System and Organization Controls (SOC) framework, but they serve very different purposes. To make things even more complex, businesses must also figure out how GRC (Governance, Risk, and Compliance) fits into the picture.

This article breaks down the differences between SOC 1 and SOC 2, explains when each applies, and shows how GRC supports both.

What is SOC?

SOC reports were developed by the American Institute of Certified Public Accountants (AICPA) to help service organizations demonstrate their internal controls to clients and regulators.

There are three types of SOC reports—SOC 1, SOC 2, and SOC 3. For most businesses, the real question comes down to SOC 1 vs SOC 2 because these are the ones most commonly requested during vendor due diligence.

What is SOC 1?

SOC 1 reports focus on internal controls over financial reporting (ICFR).

If your services could impact your client’s financial statements—for example, payroll processing, billing, or transaction management—then SOC 1 compliance is what your customers will expect.

- Purpose: Ensure accurate financial reporting.

- Audience: Primarily auditors, CFOs, and accounting teams.

- Example: A company that processes payroll data undergoes a SOC 1 audit to prove its systems produce accurate, reliable results.

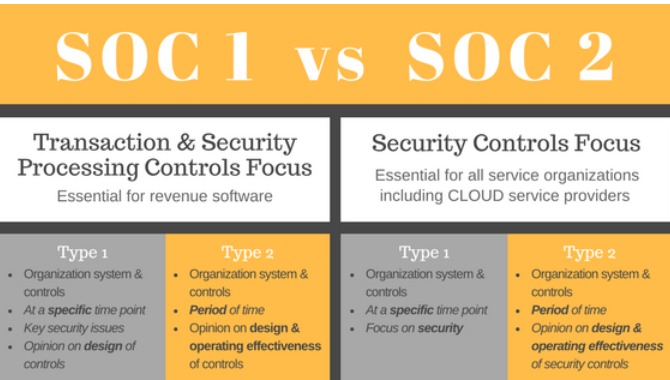

SOC 1 audits can be Type I (point-in-time assessment of controls) or Type II (operating effectiveness tested over time).

What is SOC 2?

SOC 2, on the other hand, focuses on data security and operational controls. It’s based on the Trust Services Criteria (TSC):

- Security – Protection against unauthorized access.

- Availability – Ensuring systems are up and running.

- Processing Integrity – Accuracy and reliability of operations.

- Confidentiality – Safeguarding sensitive business data.

- Privacy – Protecting personal information.

- Purpose: Demonstrate strong data security and risk management.

- Audience: Customers, partners, and stakeholders.

- Example: A SaaS company hosting sensitive client information undergoes SOC 2 to prove its systems are secure and reliable.

Like SOC 1, SOC 2 comes in Type I (design of controls) and Type II (effectiveness over time).

SOC 1 vs SOC 2: The Key Differences

| Aspect | SOC 1 | SOC 2 |

| Focus | Financial reporting controls | Security, availability, confidentiality, processing integrity, privacy |

| Primary Users | Auditors, CFOs, financial teams | Customers, partners, regulators |

| Best For | Payroll, billing, financial services providers | SaaS, cloud providers, tech companies |

| Type of Controls | Internal controls over financial reporting | IT systems, security policies, operational controls |

| Report Style | Technical, financial-focused | Security-focused, customer-friendly |

In short: SOC 1 protects financial accuracy, while SOC 2 protects data security and trust.

Where Does GRC Fit In?

Whether you’re pursuing SOC 1 or SOC 2, success depends on how well your organization manages governance, risk, and compliance (GRC).

Here’s how GRC supports both:

- Governance – Establishes policies and accountability across departments to meet SOC requirements.

- Risk Management – Identifies gaps that could impact financial reporting (SOC 1) or security operations (SOC 2).

- Compliance – Provides processes and documentation to satisfy audit requirements and prove controls are working.

Without a strong GRC framework, preparing for SOC audits often becomes chaotic and reactive. With GRC, compliance is ongoing and proactive.

When to Pursue SOC 1 vs SOC 2

The right report depends on what your business does and what your customers expect.

- Choose SOC 1 if…

- Your services impact customer financial reporting.

- You process payroll, billing, or accounting data.

- Your clients’ auditors request it.

- Your services impact customer financial reporting.

- Choose SOC 2 if…

- You store, process, or transmit sensitive customer data.

- You operate in SaaS, cloud, or IT services.

- Your customers want assurance that their data is secure.

- You store, process, or transmit sensitive customer data.

Some organizations even pursue both SOC 1 and SOC 2 if they handle financial data and sensitive customer information.

Benefits of SOC 1 and SOC 2 Compliance

1. Trust and Transparency

SOC reports provide independent validation of your internal controls, helping customers feel confident in your services.

2. Competitive Edge

More companies now require SOC reports during the vendor selection process. Being compliant can open doors to enterprise contracts.

3. Risk Reduction

SOC audits help organizations identify weaknesses and improve processes before issues lead to financial misstatements or security breaches.

4. Regulatory Alignment

SOC reports often overlap with other compliance frameworks (SOX, ISO 27001, HIPAA), reducing redundancy.

5. Operational Efficiency

Implementing controls for SOC audits often leads to more structured, scalable processes across the business.

Challenges in SOC Compliance

Even with GRC in place, companies often struggle with:

- Documentation Gaps – Auditors require clear, detailed evidence of controls.

- Time Commitment – SOC 1 and SOC 2 audits can take months of preparation.

- Leadership Buy-In – Without executive support, compliance efforts stall.

- Manual Processes – Tracking controls in spreadsheets leads to errors and inefficiency.

Best Practices for SOC 1 and SOC 2 Compliance

- Start with a Gap Analysis – Identify missing policies or weak controls early.

- Automate Evidence Collection – Use GRC tools to streamline monitoring and reporting.

- Assign Clear Ownership – Define roles and responsibilities for compliance tasks.

- Train Your Team – Ensure employees understand compliance is part of their daily responsibilities.

- Conduct Readiness Assessments – Test your controls before the official audit to avoid surprises.

Final Thoughts

Whether your organization needs SOC 1, SOC 2, or both, the ultimate goal is the same: building trust through verified internal controls.

- SOC 1 demonstrates that your financial reporting processes are reliable.

- SOC 2 proves that your data security and operational practices are strong.

- GRC compliance ensures you can manage both effectively, not just once, but continuously.

In an age where both financial accuracy and data security are under intense scrutiny, investing in SOC compliance supported by a strong GRC framework is more than just a checkbox—it’s a competitive advantage.

Yo, anyone struggling with signup? I used winbuzzsignup and it was super easy peasy. All good here, ready to dive in!

Looking for a good slot selection? phspinslot is a decent shout. They have a pretty wide range of games, and I’ve hit a few jackpots! Definitely worth a look at phspinslot.

hi!,I love your writing so a lot! proportion we keep in touch extra approximately your post on AOL? I require a specialist on this space to resolve my problem. May be that is you! Taking a look forward to peer you.

For the lives I’m playing, I look for 58jllive it’s safe, secure and helpful. Its site is super easy to access!

Hey! I know this is kind of off topic but I was wondering which blog platform are you using for this site? I’m getting sick and tired of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform. I would be great if you could point me in the direction of a good platform.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get bought an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this increase.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

The other day, while I was at work, my sister stole my apple ipad and tested to see if it can survive a forty foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is totally off topic but I had to share it with someone!

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

I have been absent for a while, but now I remember why I used to love this web site. Thank you, I will try and check back more often. How frequently you update your web site?

Exactly what I was looking for, appreciate it for putting up.

I cherished as much as you’ll obtain performed right here. The comic strip is attractive, your authored material stylish. nevertheless, you command get got an impatience over that you would like be handing over the following. sick surely come more formerly once more as exactly the same nearly very incessantly inside case you protect this hike.